Foundation Repair – Does Homeowners Insurance Cover It?

If a peril happens to your home, homeowners insurance will likely cover the damage, but it can depend on the situation. Your homeowner’s insurance policy has a standard list of coverages you can count on, but it’s important to know when damage does or does not fall under this list. But does homeowners insurance cover foundation repair?

If you need a home foundation inspection or repair, consider reaching out to a team of professionals.

In the meantime, let’s dissect the likelihood of getting these services covered through homeowners insurance.

What Can I Expect Homeowners Insurance to Cover?

Some examples of things most home insurance policies always cover include:

- Lightning strikes

- Fire damage

- Wind damage

- Vandalism

- Falling objects like tree branches

- Structural collapse due to the weight of snow and ice

- Water damage from plumbing and HVAC

That’s a great question that we’ll answer today, plus go through how to handle foundation damage and problems without worry.

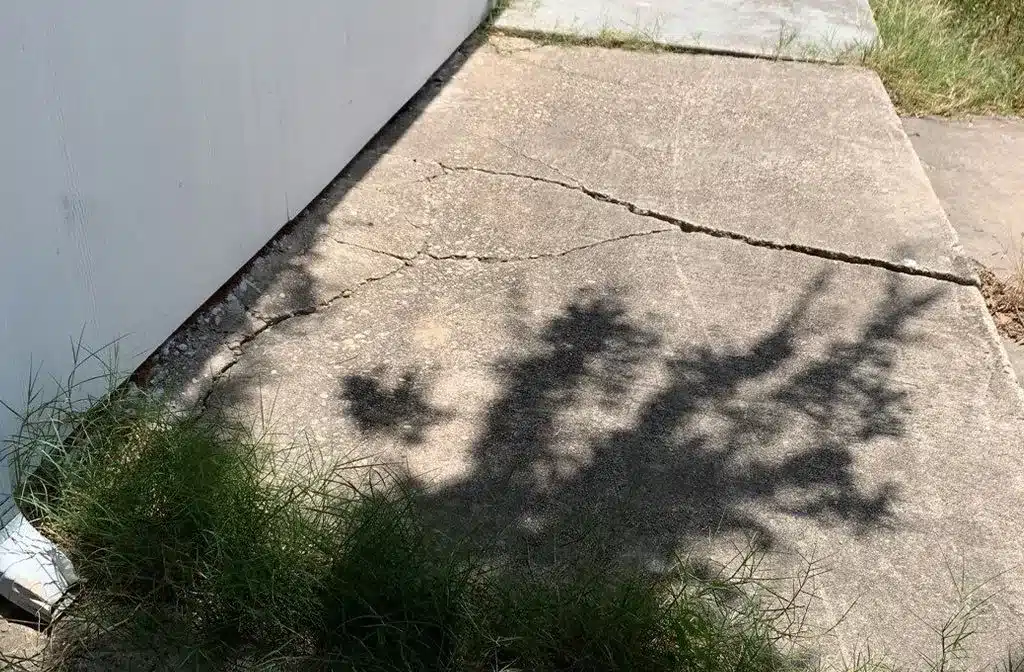

What Are The Signs of Foundation Damage?

First, it’s very important to determine whether or not your foundation has damage that warrants an insurance claim. Some common signs of foundation issues might include:

- Exterior wall cracks

- Warped or bowing siding

- Sinking ground near the foundation

- Bouncy floors

- Damp crawl space and basement

- Cracks in the drywall

- Windows and doors “sticking”

- Uneven floors

- Poor drainage

- Cracks in floor tiles

- Cabinets, countertops, window frames, etc., pulling away from the wall

Many homeowners may never think about their foundation until they notice any of the above symptoms. And while these may not all be due to immediate foundation damage, they can occur over time and still require repairs to get done ASAP.

What Causes Foundation Problems?

Many things that affect your foundation are invisible and are happening silently beneath the surface where you don’t know what’s going on. Things that can damage your foundation over time include:

- Burrowing animals

- Termites

- Extensive root systems

- Mmuddy soil

Some more obvious threats may cause damage on the surface, such as fire damage or floods. These exterior forces can’t be controlled, but you can help combat them by having a solid foundation and taking the proper precautions, like having proper drainage systems in place and keeping large trees at least 30 feet from your foundation.

Many folks will explain a creaky floor or house noises as the “foundation settling,” but chances are if your foundation is decades old, it has settled a long time ago. And in fact, if it’s continuing to “settle,” it could be from shifting soil, excess moisture, or other natural elements affecting the structural integrity of your home and foundation.

What to Do if You Experience Foundation Damage

In the case of foundation damage, you should contact your insurer immediately when the covered risk happens, and you are unsure what the cost will be. Insurance companies typically cover events for only one year past their initial occurrence date, so acting fast is vital to getting the coverage you need. Some things you can do if you experience foundation damage include:

- Collecting necessary pictures or videos to record the damage.

- Contacting your insurance company ASAP.

- If you are claiming property damage, your insurer may ask you to bring an appraiser to your property.

- Utilize your own foundation expert for an appraisal of the situation, so you can use this report in your claim.

Does Homeowners Insurance Cover Foundation Damage?

Foundation damage caused by common perils is typically covered under most home insurance policies. This means that if your foundation is damaged by severe weather, fire, or other events listed in your policy, your home insurance will likely cover the repairs.

However, if the damage to your foundation is due to poor maintenance or neglect on your part, it may not be covered. For example, if you have a flooding problem in your basement and it’s determined that the damage is due to faulty gutters or downspouts, your home insurance company may not cover the repairs.

It’s important to read your policy carefully and to understand what is and isn’t covered so that you know what to expect if you ever need to make a claim.

What Does Homeowners Insurance Not Cover?

Homeowners insurance covers a lot, but there are also many things that it doesn’t cover. Some of the most common exclusions from home insurance policies include:

- Flooding

- Earthquakes

- Sewer and drain backup

- Mold and rot

- Neglect or poor maintenance

- Termites and other pests

- Wear and tear

These are just a few of the things that may not be covered by your home insurance policy. Be sure to read your policy carefully so that you know what is and isn’t included. You may also want to consider purchasing additional coverage, such as flood insurance or earthquake insurance, to make sure you’re fully protected.

Most Importantly, Get Your Foundation Repairs Done Right

Whether you get insurance to pay for your foundation repairs or not, it still needs to be fixed. And by hiring a reputable team of foundation and soil experts, you can ensure you’re getting a foundation fix that lasts.

The Texas soil experts at Perma Pier have seen just about every type of foundation problem that can happen and have the remedies to prevent further, more costly repairs down the road. Trust us to give you a solid foundation.If you’re concerned about the condition of your foundation, we offer thorough and accurate foundation repair estimates. We’ll come out to your property, assess the damage, and provide you with a no-obligation estimate for the repairs. Contact us today to get started!